nh food sales tax

New Hampshires meals and room rental tax is 85 percent and is assessed on any facility with sleeping accommodations and restaurants. Depending on the type of business where youre doing business and.

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

If you did not receive this.

. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. Food Service License Renewals. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

A 9 tax is also assessed on motor. Approximately 45 days before the expiration of your current Food Service License you will receive a renewal applicationinvoice. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. Base State Sales Tax Rate.

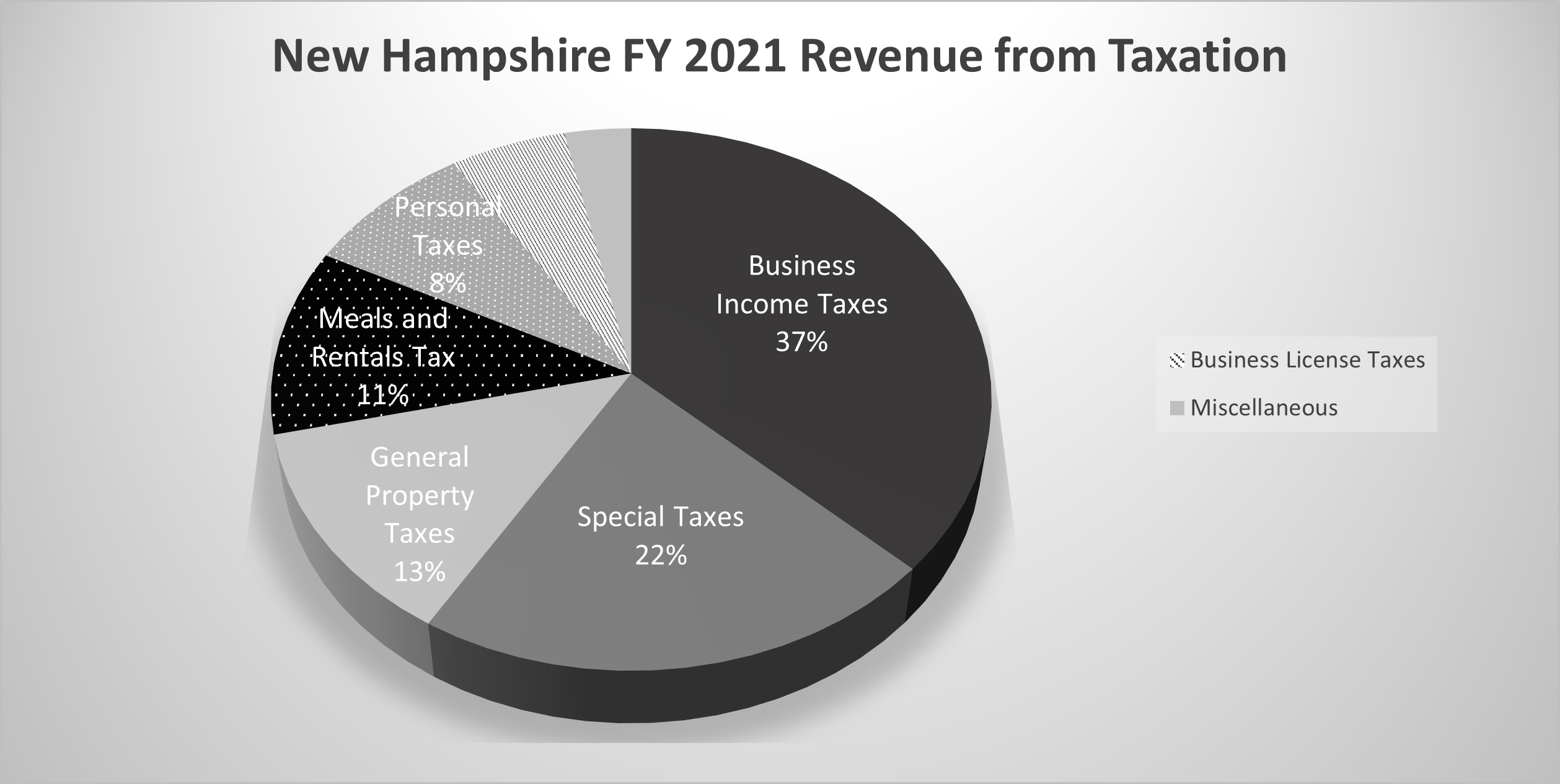

There are however several specific taxes levied on particular services or products. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. 2022 New Hampshire Sales Tax Table.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room. Please note that effective October 1 2021 the Meals Rentals Tax rate is. Combined Sales Tax Range.

Average Local State Sales Tax. Business operators collect the tax from patrons. New Hampshire Sales Tax Ranges.

Depending on the type of business where youre doing business and other specific. For Taxable periods ending on or after December. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Local Sales Tax Range. The sales tax in New Hampshire NH is presently 0.

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How Are Groceries Candy And Soda Taxed In Your State

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

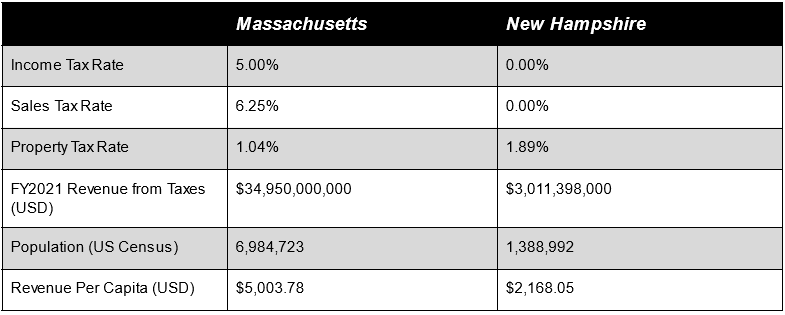

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

State Sales Tax Free Weekend Shopping Just Updated 2022

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Tax Laws By State Ultimate Guide For Business Owners

Sales Taxes In The United States Wikipedia

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

General Sales Taxes And Gross Receipts Taxes Urban Institute

Selling Homemade Food Products In New Hampshire The Basics Part One Fact Sheet Extension

General Sales Taxes And Gross Receipts Taxes Urban Institute